In today’s hyper-competitive business landscape, companies are under increasing pressure to deliver outsized returns rapid growth, market share expansion, innovation breakthroughs all while avoiding missteps and playing it safe. This mindset, though common, is fundamentally flawed.

The Paradox at the Core

Many organizations want to reap the benefits of innovation and disruption without incurring the risks associated with them. This leads to a disconnect between what they aspire to achieve and what they’re willing to risk to get there.

Symptoms of the problem include:

- Reluctance to invest in early-stage innovation

- Avoidance of markets or technologies perceived as “unproven”

- Overreliance on legacy products and incremental improvements

- Slow decision-making and lengthy approval processes

- Culture of punishing failure rather than learning from it

This environment often breeds stagnation, missed opportunities, and a growing gap between bold startups and large incumbents clinging to safety.

Understanding Risk in a New Light

Risk is not the enemy. Poorly managed or misunderstood risk is.

Risk, when approached strategically, is not a gamble it’s an investment in learning, growth, and competitive advantage. In fact, companies that have embraced smart risk-taking like Amazon, Tesla, or even Adobe have unlocked massive value through experimentation and long-term bets.

Root Causes of Risk Aversion

1. Short-Termism: Public markets and some investors pressure companies to hit quarterly targets, making leaders avoid long-term, uncertain projects.

2. Fear Culture: Internal cultures often penalize failure, creating teams that only propose “safe” ideas.

3. Lack of Risk Literacy: Leadership may not fully understand how to assess or manage innovation risk.

4. Success Trap: Established companies can be trapped by past success, unwilling to disrupt the model that worked before.

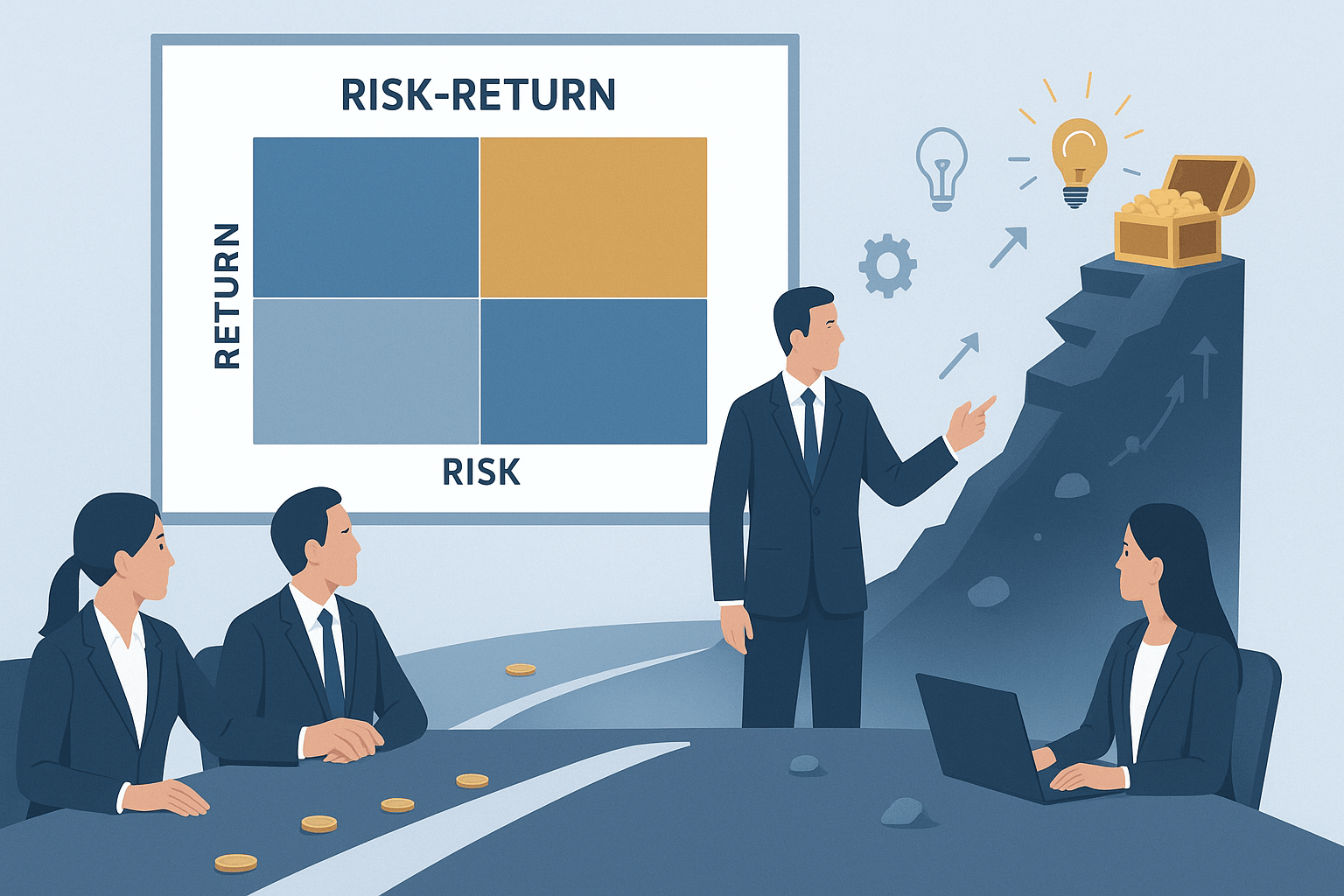

5 Solutions for Balancing Risk and Return

1. Adopt a Portfolio Approach to Innovation

Just as investors diversify assets, companies should diversify initiatives:

- 70% on core business improvements

- 20% on adjacent innovations

- 10% on disruptive “moonshot” ideas

This creates a structure that balances stability with bold experimentation.

2. Create a Culture That Rewards Learning, Not Just Success

Encourage teams to take calculated risks by celebrating lessons from failed experiments. Companies like Google and Netflix emphasize psychological safety, allowing employees to challenge the status quo.

Try this:

Set up a quarterly “Failure Forum” where teams present what didn’t work and what was learned.

3. Shift Metrics and KPIs

Instead of focusing solely on ROI, track:

- Time to market

- Number of experiments run

- % of revenue from new products

- Customer insights gathered

These metrics show progress and value creation beyond just financial return.

4. Pilot Before You Scale

De-risk innovation by testing on a small scale first.

Example: Before launching a new service nationally, test it in one city or with a single segment. Use results to iterate and build confidence for wider rollout.

5. Empower Cross-Functional Innovation Teams

Give small, autonomous teams the freedom, resources, and time to pursue ideas outside the core business. Protect these teams from bureaucratic roadblocks.

This mirrors the startup model agile, bold, and fast.

Conclusion: Safe is Risky

In a world where disruption is constant and customer expectations shift rapidly, doing nothing or only making small, safe bets is the greatest risk of all.

Companies that shift from risk avoidance to risk management and intelligent experimentation will be best positioned for long-term success and high returns.